Proteomics International Laboratories Ltd (ASX:PIQ) is a healthcare stock poised for an exciting 2025. With three innovative diagnostic tests set to be commercialised in key global markets, the company is on the verge of transforming the landscape of early disease detection. For investors, this marks a significant turning point, offering the potential for substantial returns if Proteomics can execute its plans successfully.

Recap of Proteomics (ASX:PIQ)

Proteomics is named after the scientific field dedicated to studying proteins’ structure and function. The company’s diagnostic tests are based on the premise that certain diseases can be detected earlier by identifying specific biomarkers in a patient’s blood. This approach offers a less invasive and more precise alternative to conventional disease detection methods, which often identify conditions at advanced stages.

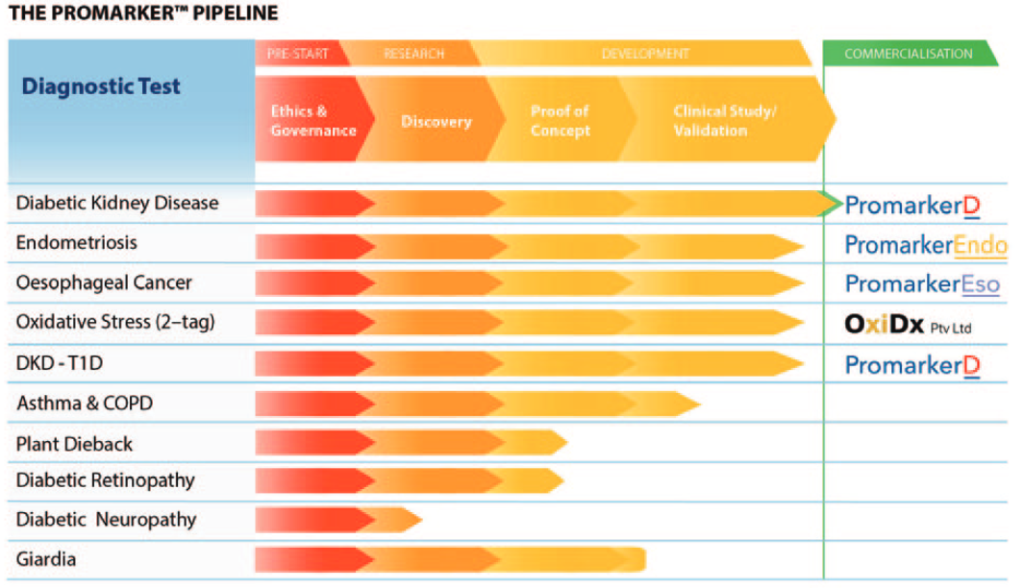

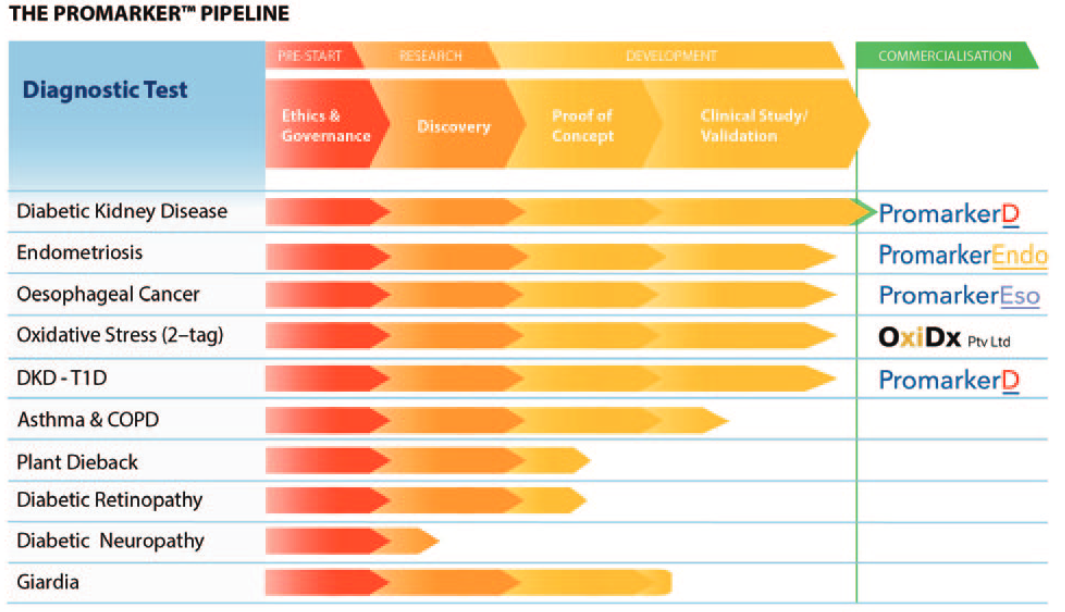

Proteomics has three groundbreaking tests, each clinically validated and targeting significant commercial opportunities:

PromarkerD: A predictive test for Diabetic Kidney Disease (DKD).

PromarkerEndo: A diagnostic test for Endometriosis.

PromarkerEso: A diagnostic test for Esophageal Cancer.

The rollout of these tests will begin in 2024 with PromarkerD in Australia, followed by launches in the USA and Europe in 2025. PromarkerEndo and PromarkerEso are expected to debut in mid-2025 in Australia, with gradual expansions into international markets over the following two years.

A Big Opportunity Awaits

Proteomics’ diagnostic tests address substantial unmet medical needs, with large addressable markets in Australia, the USA, and Europe:

PromarkerD: Targets the two-thirds of diabetics without DKD, representing a market of 21.1 million people in the USA, 40.9 million in the EU, and 1 million in Australia.

PromarkerEndo: Addresses endometriosis, affecting approximately one in nine women of childbearing age—7.39 million in the USA, 14.8 million in the EU, and 609,000 in Australia.

PromarkerEso: Offers an alternative to endoscopic scans for Esophageal Cancer, with a market potential of 390,000 people in Australia, 1.5 million in the USA, and 2 million in the EU.

Proteomics’ strategy includes using the Lab Developed Test (LDT) pathway for commercialisation in the USA as an alternative to FDA 510(k) approval. In Australia, the tests will be launched via the ISO 15189 pathway, and PromarkerD already holds CE Mark approval for Europe. Medicare reimbursement for PromarkerD in the USA is set at $390.75, enhancing its market appeal.

Innovative Go-to-Market Strategy

Proteomics is adopting a hybrid commercialisation model. It combines a traditional licensing approach with a Direct-to-Customer/Patient (DTC/DTP) model. While this may slow market penetration compared to a full licensing strategy, it allows the company to retain a larger share of revenue. This innovative approach ensures flexibility and maximises long-term profitability.

Additionally, Proteomics’ aspirations extend beyond its current tests. The company aims to develop diagnostics for conditions such as Asthma, Chronic Obstructive Pulmonary Disease (COPD), Plant Dieback, Diabetic Retinopathy, and Diabetic Neuropathy. This vision positions the company as a leader in proteomics-based diagnostics.

Pitt Street Research’s Bullish Outlook

According to Pitt Street Research, Proteomics’ future is promising. The firm values the company at $295.3 million in a base case scenario and $446.6 million in an optimistic scenario, translating to $2.19 and $3.31 per share, respectively. These valuations hinge on the successful commercialisation of the three tests within the proposed timeline.

Investors are encouraged to review Proteomics’ recent presentations, including its appearance at the Stocks Down Under Healthcare and Life Sciences Conference. These insights offer a deeper understanding of the company’s growth strategy and market potential.

Conclusion

Proteomics (ASX:PIQ) is positioned for a transformative 2025, driven by its innovative diagnostic tests and strategic commercialisation plans. For shareholders, the year promises significant milestones, from the Australian debut of PromarkerD to the global rollout of PromarkerEndo and PromarkerEso. The company’s hybrid go-to-market strategy and ambitious pipeline underscore its potential to disrupt the diagnostics industry.

As the healthcare landscape evolves, Proteomics’ ability to detect diseases earlier and more accurately positions it as a critical player. For investors, the company’s progress in 2025 could unlock substantial value, making it a stock to watch closely.

One thought on “Proteomics (ASX:PIQ) Shareholders Should Brace Themselves in 2025”